Save up,

Live more

Big plans? Whether you get there in small steps or giant leaps is all up to you. You can set some money aside every month or go for the long haul—even change your mind along the way. It’s your money, right?

Every reason to start saving

ATTRACTIVE RATES

You want to see your savings go up. That’s why we offer you attractive rates to help you do just that.

TAILORED TO YOUR NEEDS

Your money is your money. So you choose the savings solution that suits you best.

100% BELGIAN

We operate from Belgium, following Belgian law.

What’s your saving style?

The indispensable

MeDirect Essential Savings

Unexpected situations? This savings account yields right from the start and helps you deal with bad surprises!

You can deposit a maximum of €25,000 into this account.

A regulated savings account complies with certain rules for partial tax exemption. This savings account offers a base rate and a fidelity premium and the money is available without notice.

Thinking long-term

MeDirect Fidelity Savings

Not a big fan of surprises, are you? Then here’s your safety net. Save up for a rainy day or allow yourself a luscious retirement plan, but know you’ll always have a plan B.

A regulated savings account complies with certain rules for partial tax exemption. This savings account offers a base rate and a fidelity premium and the money is available without notice.

Quick & Good

MeDirect Dynamic Savings

A round-the-world trip, or maybe a bigger TV? Yes, you can. For here’s an account that’s just as spontaneous as your plans.

A regulated savings account complies with certain rules for partial tax exemption. This savings account offers a base rate and a fidelity premium and the money is available without notice.

Fixed Period

MeDirect Term Deposit Account

Save for a fixed period of time?

A Term Account has a predefined term during which your money is not available.

Disclaimer:

A regulated savings account is a technical term for an account where the interest received is partially tax-exempt. To qualify for this partial tax exemption, the savings account must comply with several rules established by law. A term account is an account in which you deposit your savings for a certain period of time. For this deposit you will receive a fixed interest rate until the end of the period. You pay 30% withholding tax on this interest.

Four facts about

our savings products

Interest rates for savings & term deposit accounts aren’t set in stone. The correct rates are always available on our website.

Your savings are guaranteed up to €100.000. Any deposits you have over €100.000 could be reduced or converted into shares (bail-in). Find out more in the Deposit Protection Information Sheet.

Everything you want to do, you can do right from your home, on the train, at work or anywhere you like. We’re online-only.

You can find more information about our savings products on their respective pages. We encourage you to read them carefully.

Still have questions?

How do I open an account ?

- Click ‘Become a client’ to start the online application process. You will be asked if you wish to open up a single or a joint account. Complete your personal data as requested on screen.

- You will be guided to provide a clear copy of the front and back of a valid Belgian ID and to take a selfie.You can choose from the following 2 options:

- Use your smartphone to take a photo of your ID and a selfie.

- Upload a photo or a scan of your ID and take a selfie using the camera on your electronic device (eg webcam).

- Complete the online application process and sign it digitally. Keep your mobile close at hand.

- Make a first payment to your MeDirect Cash Account from an external account registered in your name.

- If you applied to open a joint account, you can transfer your first payment from an external joint account (registered in the name of both account holders) or from two different accounts, each registered in the name of the individual account holder.

- Once the payment has been received, a MeDirect Cash Account will be opened for you. You will then get full access to the secure website.

How can I deposit funds in my account?

You can deposit funds by instructing a bank transfer from an external bank account to your MeDirect account.

Are there any fees for opening an account?

Helpful answers

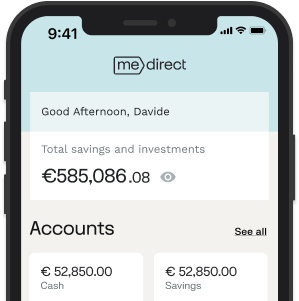

Start saving

The sooner you start managing your money your way, the sooner you’ll see results. Make your own choices and find what feels good. Sign up and open your account in a heartbeat.