MeDirect Fixed

Term Account

1 to 5 years |

|---|

Stay as long as you like |

| Annual payout |

|---|

Reap the benefits once a year |

€ £ $ |

|---|

Three currencies to choose from |

It's free |

|---|

Talk about saving money |

Attractive rates (annual rates)

|

|

EUR

|

GBP

|

USD

|

|||

|---|---|---|---|---|---|---|

|

TYPE

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

|

1 years

|

2.86%

|

2.00%

|

1.00%

|

0.70%

|

0.75%

|

0.53%

|

|

2 years

|

2.86%

|

2.00%

|

1.14%

|

0.80%

|

0.85%

|

0.60%

|

|

3 years

|

2.86%

|

2.00%

|

1.29%

|

0.90%

|

0.95%

|

0.67%

|

|

4 years

|

2.86%

|

2.00%

|

1.43%

|

1.00%

|

1.05%

|

0.74%

|

|

5 years

|

2.86%

|

2.00%

|

1.57%

|

1.10%

|

1.15%

|

0.80%

|

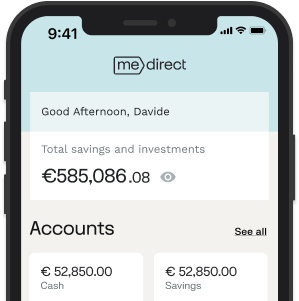

Online saving for planners

You set the term, we promise you a fixed rate for that entire period. Once your money has matured, we’ll set it free again for you to spend.

You choose your currency. Whether you prefer Euro, US Dollar or British Pound, your minimum amount starts at 100 €/£/$.

Interest rates for savings accounts aren’t set in stone. If yours change, we’ll email you. The correct rates are always on our website, too. Also note that your account exists online, and online only. Check it on the go and make any changes you like in an instant.

This product is created by MeDirect Bank S.A. (Belgian law applies).

If we ever go bankrupt, your savings will be guaranteed up to € 100.000 euro, which you will receive in cash. any deposits you have over € 100.000 euro could be reduced or converted into shares (bail-in). Inflation risk: Continuing price rises could lead to a loss in value of the saved money.

If you disagree with our proposed solution, you can contact the Consumer mediation office for financial services (Ombudsfin), Boulevard du Roi Albert II 8, box 2, B-1000 Brussels. 02/545.77.70, ombudsman@

ombudsfin.be.

Please also read our Fixed Term Deposit fact sheet before opening an account and note that there’s no other Essential Information for Savers.

Please find our interest rates below. the net interest rate shows the rate after deduction of your 30% withholding tax. Don’t worry, the amount will be automatically deducted.

Similar products

MeDirect

Dynamic Savings

With the MeDirect Monthly Max savings account, you save up at your own pace, for the purpose you determine. Surfing in Bali? A new natural stone terrace?

It’s up to you.

MeDirect

Monthly Savings Max

Here’s an account that gives you attractive rates and instant online access. Did we mention it’s free? It’s free.

In case you are fresh to start.

How do I open an account ?

- Click ‘Become a client’ to start the online application process. You will be asked if you wish to open up a single or a joint account. Complete your personal data as requested on screen.

- You will be guided to provide a clear copy of the front and back of a valid Belgian ID and to take a selfie.You can choose from the following 2 options:

- Use your smartphone to take a photo of your ID and a selfie.

- Upload a photo or a scan of your ID and take a selfie using the camera on your electronic device (eg webcam).

- Complete the online application process and sign it digitally. Keep your mobile close at hand.

- Make a first payment to your MeDirect Cash Account from an external account registered in your name.

- If you applied to open a joint account, you can transfer your first payment from an external joint account (registered in the name of both account holders) or from two different accounts, each registered in the name of the individual account holder.

- Once the payment has been received, a MeDirect Cash Account will be opened for you. You will then get full access to the secure website.

How can I deposit funds in my account?

You can deposit funds by instructing a bank transfer from an external bank account to your MeDirect account.

Are there any fees for opening an account?

Helpful answers

Start saving

The sooner you start managing your money your way, the sooner you’ll see results. Make your own choices and find what feels good. Sign up and open your account in a heartbeat.