Everything about

Asset Transfers

Choose what you want to know about Asset Transfers.

Understanding the Asset Transfer Process

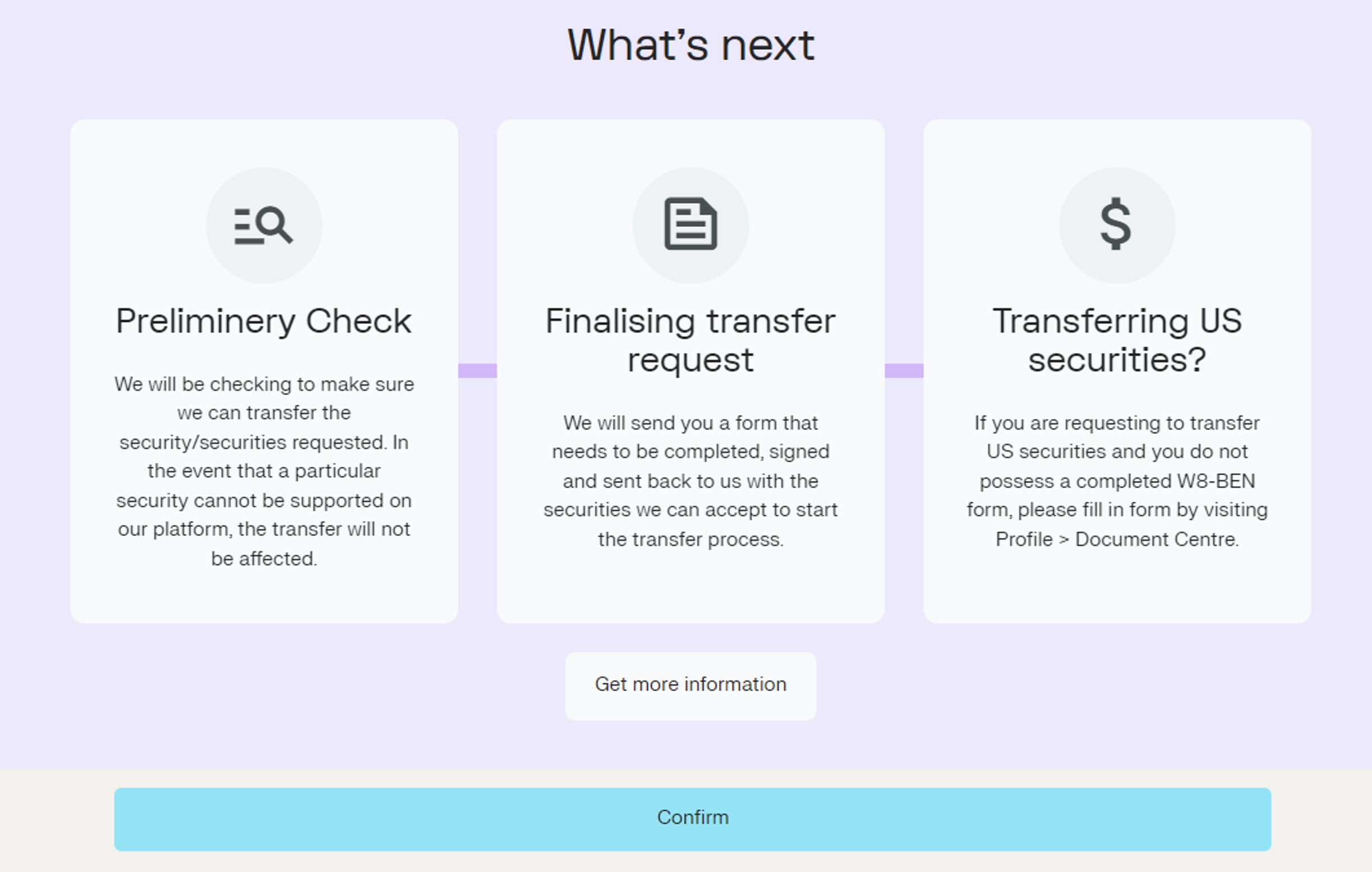

The process commences with you, the client, expressing your intent to transfer your portfolio to MeDirect. We will gladly initiate the process upon receiving this information. Initially, we will need details on the securities you wish to transfer to verify if we can accept them. For securities already available with us, acceptance is swift. However, for those not yet offered, a series of checks are necessary to determine acceptance. These checks include verifying if the security is tradable on an exchange we support, traded in a currency we accept, is one of the acceptable instrument types (shares, bonds, mutual funds, and ETFs), and for ETFs and mutual funds, whether KID documents are available.

These verification processes are time-consuming.

Once the acceptable securities are identified, we will require a signed transfer form containing details of your current bank or broker, account numbers, and a wet ink signature (as electronic signatures are generally not accepted by Belgian banks). The asset transfer form to be filled in will be shared with you via secure message.

Upon receiving the signed asset transfer form, a new round of checks ensues. We verify the accuracy of the MeDirect account number, the signature on the form, and other relevant details. Our transfer department then contacts your current bank or broker to initiate the transfer process. This step may take days, or even weeks, as your current institution conducts its own set of checks. They verify signatures, account balances, outstanding orders, and may require approvals from both the branch and headquarters. Once completed, they inform us of the transfer status. If all parties agree, agreements are made on the transfer and settlement dates. Instructions are then sent to custodians for the transfer to occur on the agreed-upon date.

Given the numerous checkpoints and stakeholders involved, the entire process can last up to eight weeks. Delays may occur due to various issues, prolonging the transfer duration.

Requesting an Asset Transfer:

Before initiating a transfer, opening an investment account is a prerequisite.

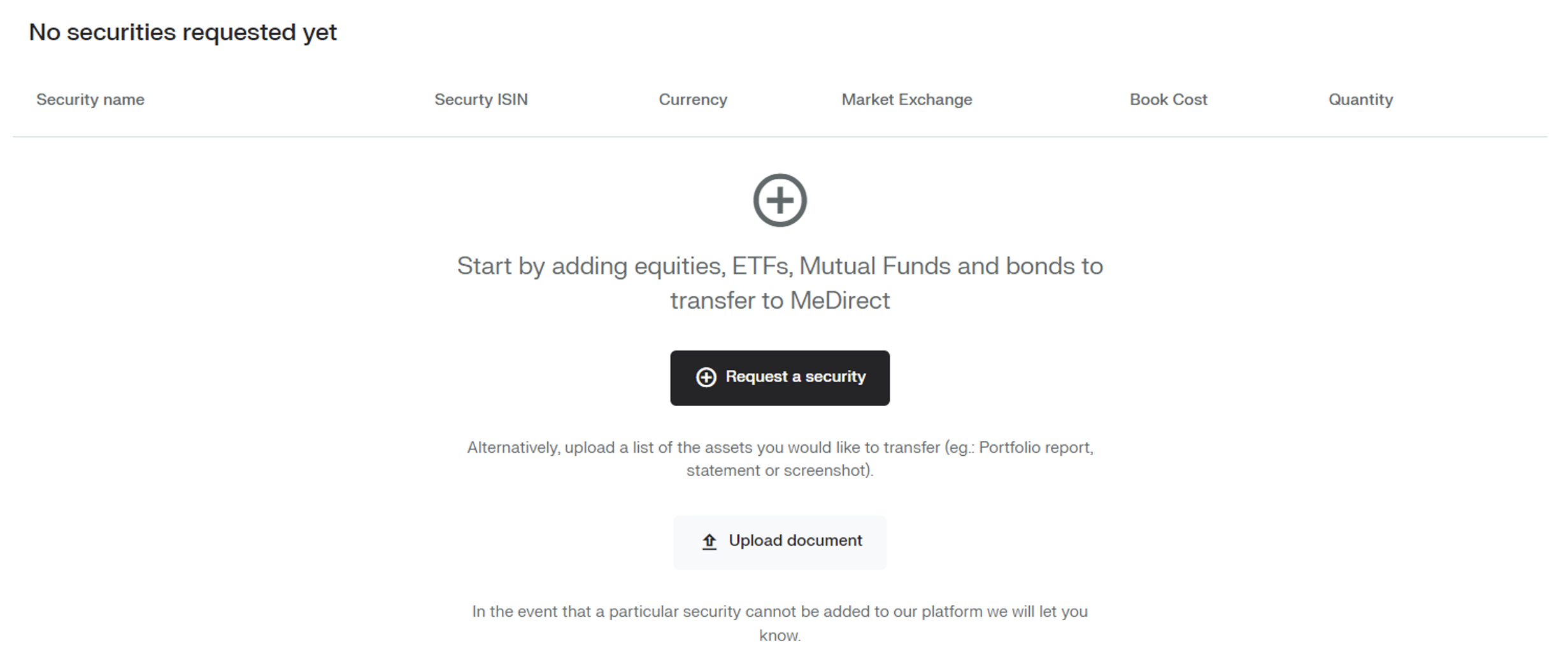

Once your investment account has been opened, two methods are available to request an asset transfer, both accessible through the platform or app.

- • Upload a document (portfolio overview, account statements, etc.).

- • Enter the securities manually for transfer.

Let’s walk through the two options using the web platform as an example.

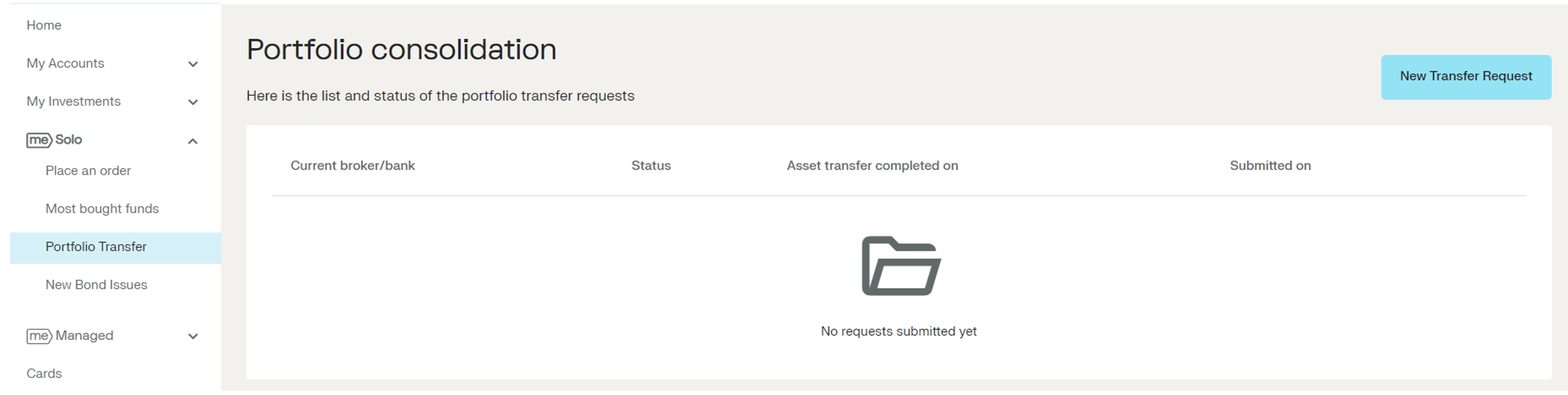

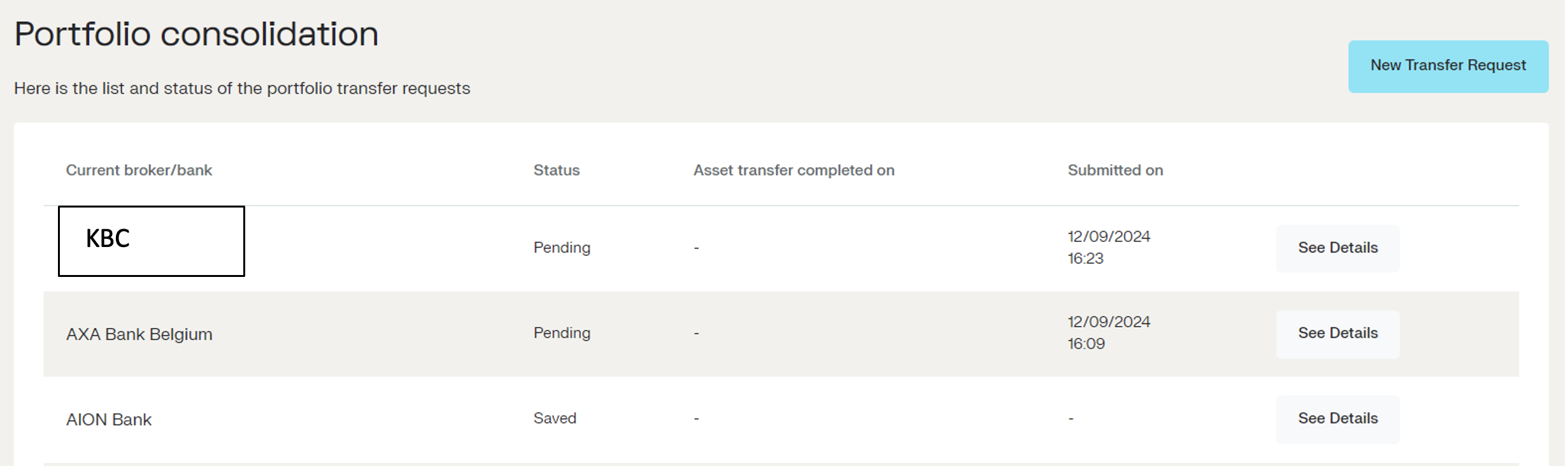

Once you are logged into your personal platform, you can select the ‘Portfolio Transfer’ from the MeSolo menu, and this will take you to an overview page where you will be able to request a new asset transfer, or view your pending or closed asset transfers.

The two different options to request the asset transfer become available:

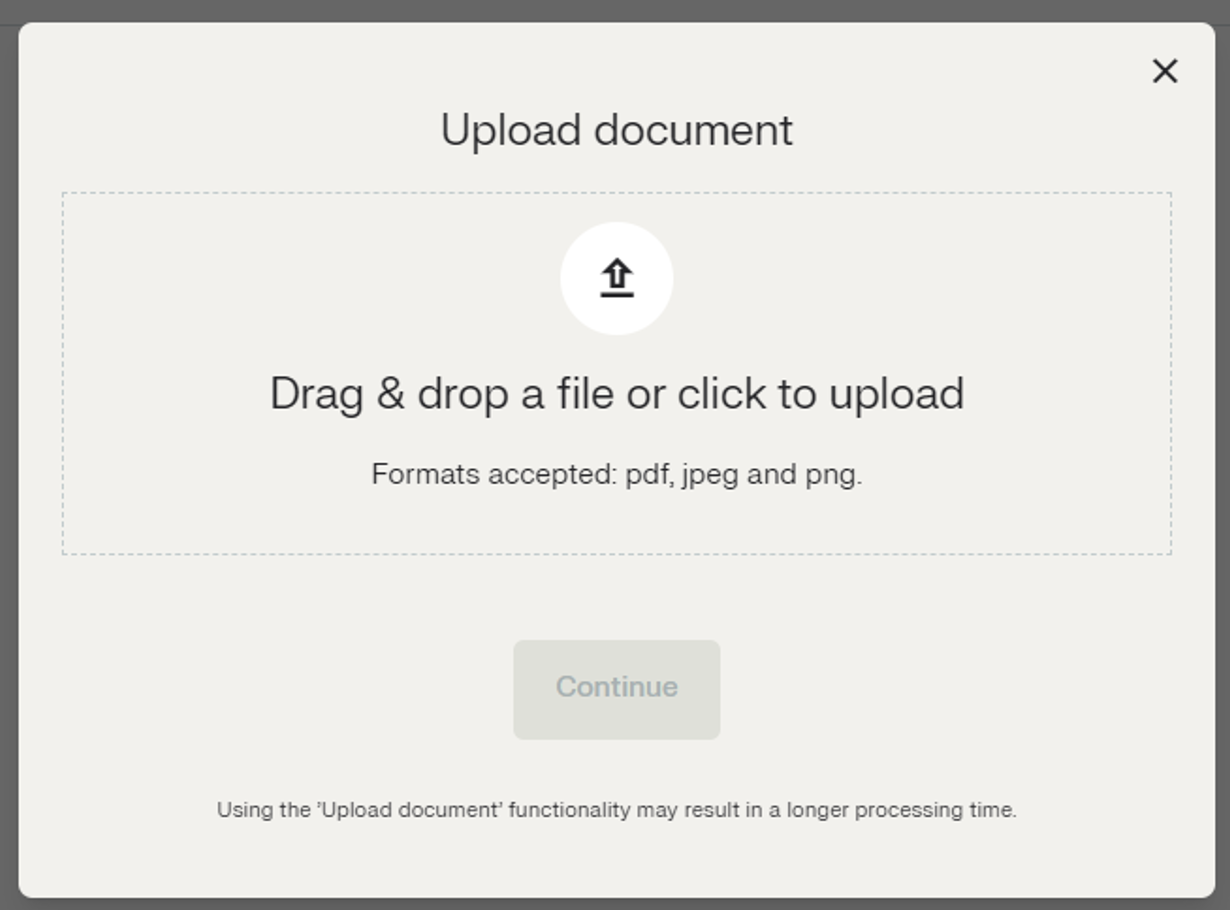

- 1. You can simply upload a document showing the securities you wish to transfer. The accepted formats are PDF, jpeg and PNG, and the document can be a maximum size of 4MB. Please do keep in mind that the uploaded document must contain specific information regarding the securities you wish to transfer: name, ISIN, the market exchange and the currency in which you hold the security.

Once the document has been uploaded, we will start the asset transfer process and will keep you informed regarding next steps, or if additional information is required.

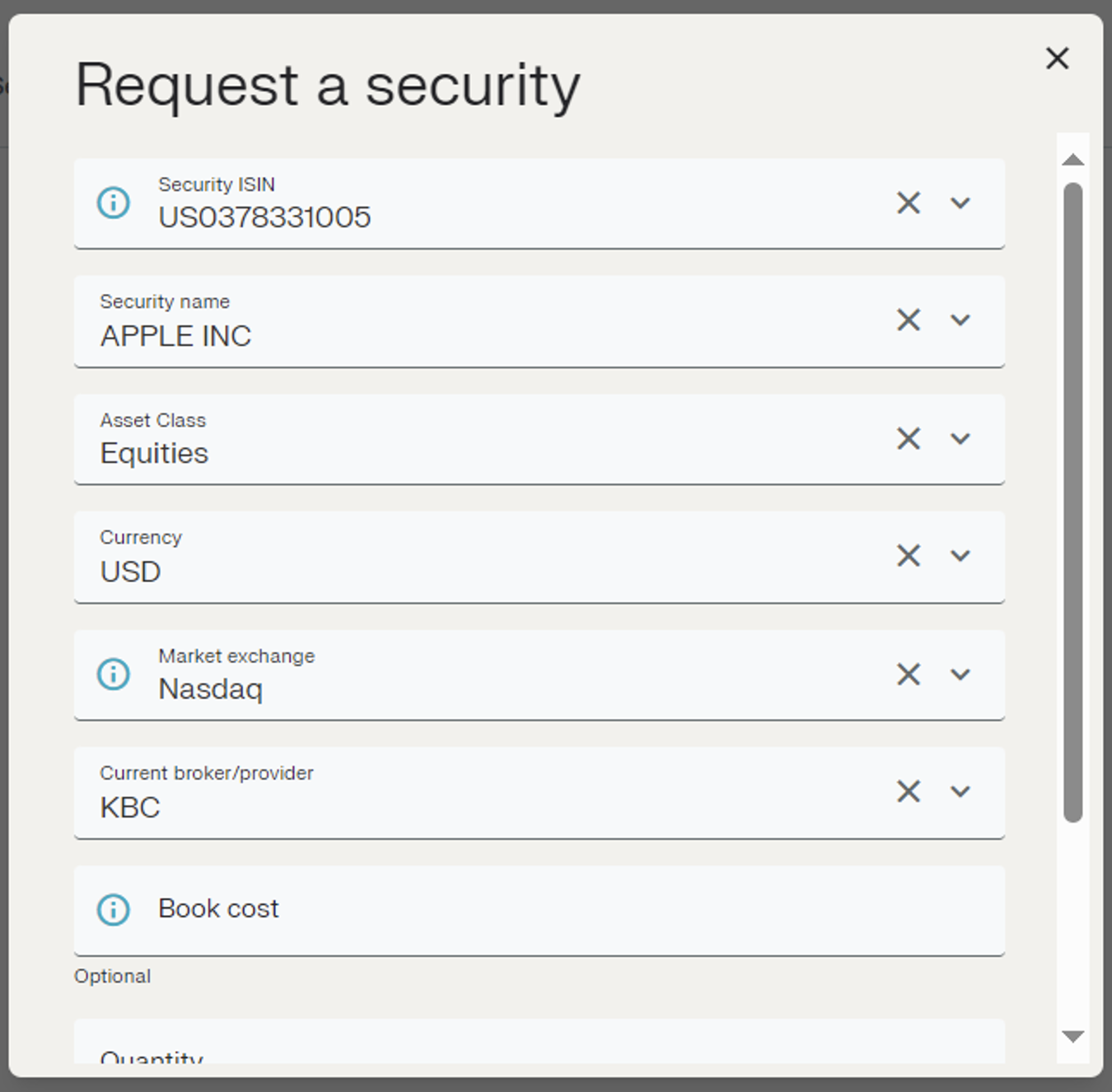

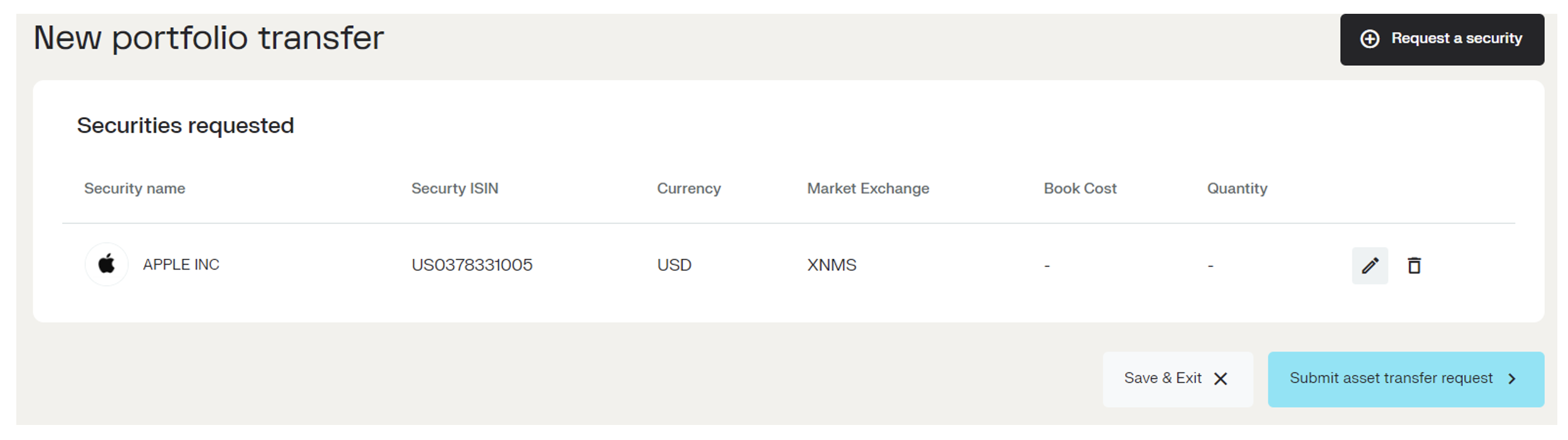

- 2. If you only wish to transfer part of your portfolio, or you are not comfortable with sharing the necessary documents, you have the option to request the securities you wish to transfer one by one by clicking on ‘Request a security’.

You simply fill in the form and click the ‘Request a security’ button:

If you have entered all the securities you wish to transfer, you can submit your asset transfer request and you will be redirected to the overview screen:

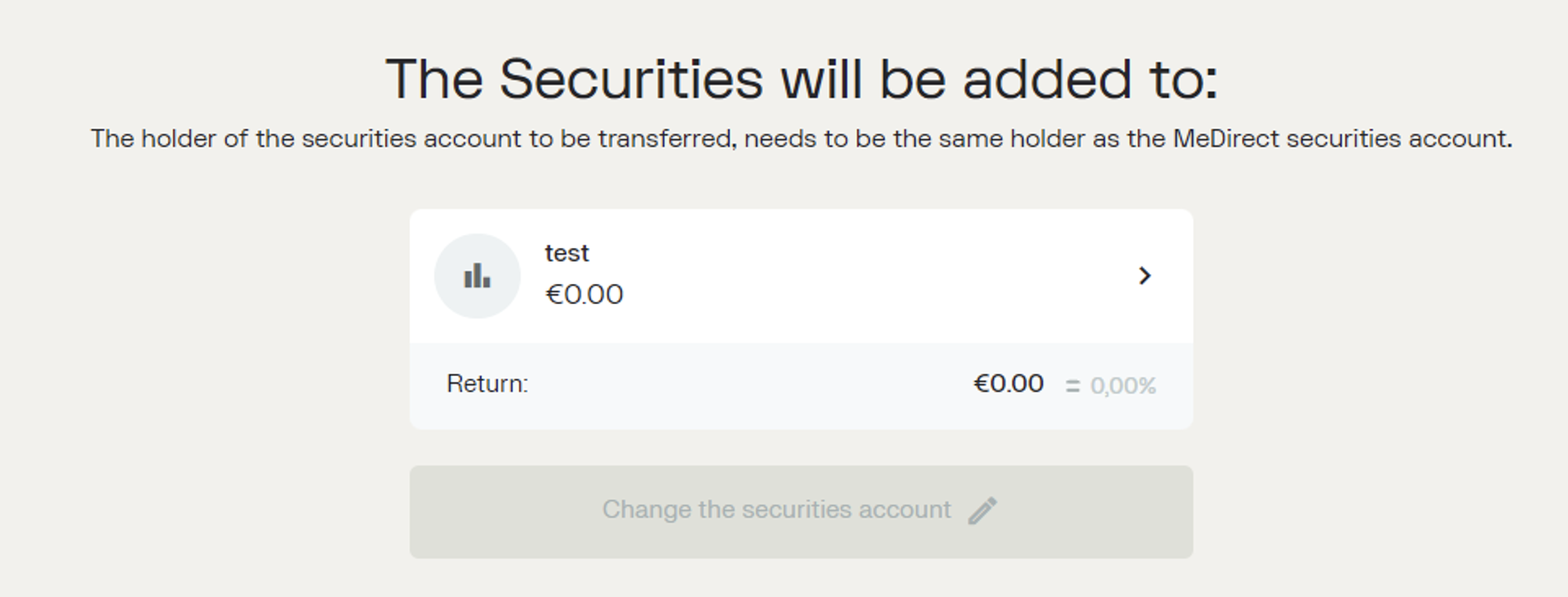

In the overview page, you can also select the securities account where you would like the securities to be booked. Just keep in mind that the MeDirect securities account needs to be in the same name as the securities account at the other bank/broker as we cannot allow a change of beneficial ownership.

You can see whether a transfer request is saved (but not submitted yet) or pending. If the request is cancelled, you will see the status ‘cancelled’, and once the asset transfer is completed, you will see the status ‘completed’. This way you can follow up all your requested asset transfers.

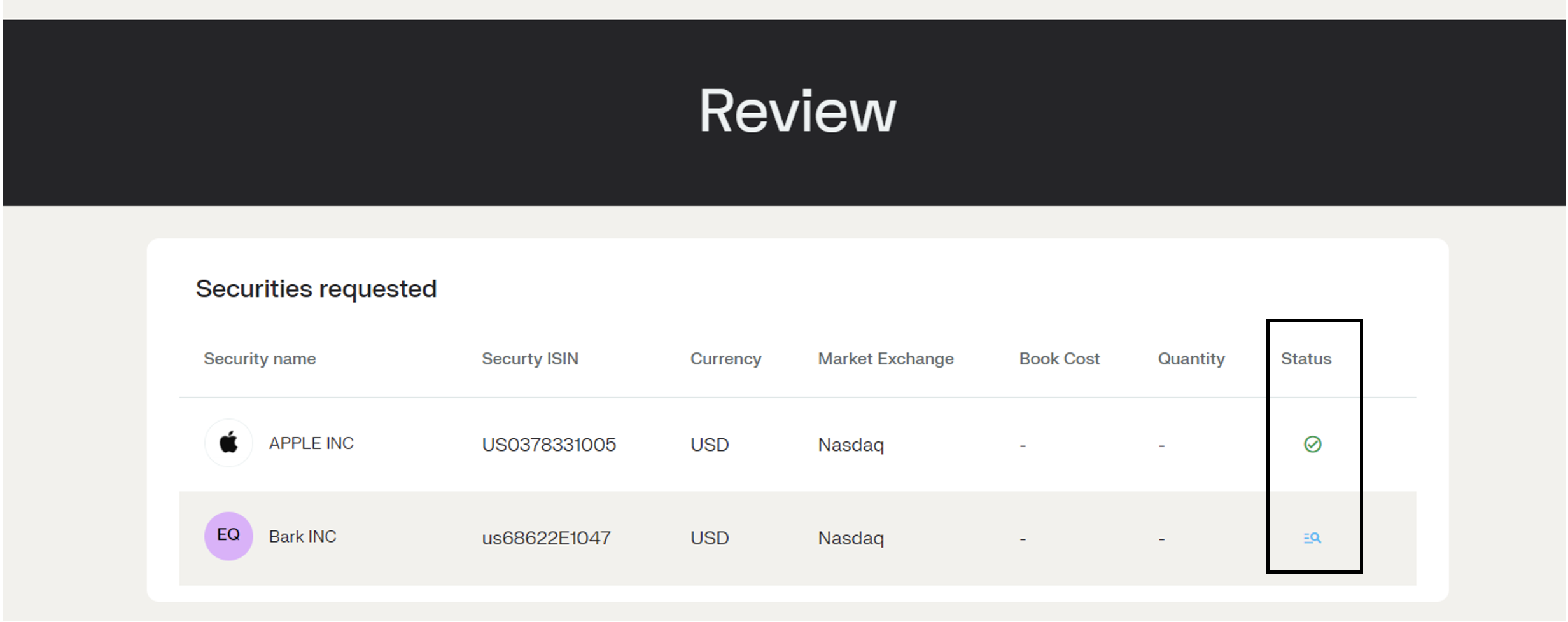

Go back to the requested securities overview by clicking on ‘Details’, and the availability status will be updated in real time. That means that if you requested a security which was not yet available in our securities universe, but our teams confirm it can be added, the status will change from ‘Checking availability’ to ‘Available’.

As soon as our teams have confirmed whether or not the requested securities can be transferred to your MeDirect Securities Account, our contact center colleagues will contact you via a secure message to inform you about the next steps in the asset transfer process

Beneficial Ownership Change:

MeDirect accepts asset transfers only if there is no change in beneficial ownership. This implies that the account holders of the securities account being transferred must match those of the MeDirect account.

For instance:

- 1. No change in beneficial ownership: At bank A the securities account is in the name of Mrs. Willems, and Mrs. Willems would like to transfer her portfolio to MeDirect. At MeDirect Mrs. Willems has a MeSolo account in just her name.

- 2. Change in beneficial ownership: Mrs. Willems also has a portfolio at bank B together with her husband Mr. Janssens and they would like to transfer this portfolio to MeDirect as well to consolidate all their assets. However, only Mrs. Willems has a securities account at MeDirect in her name only.

- 3. Solution: Opening a joint MeSolo account allows the transfer without a change in beneficial ownership.

Requests involving a change in beneficial ownership, such as those from succession or donation cases, are reviewed on a case-by-case basis.

Reimbursement of Transfer Fees

Upon requesting an asset transfer, your current bank or broker may charge transfer fees. The amount of the transfer fee differs at every financial institution and we recommend that you contact your bank or broker to know the exact fee that they will charge.

As a commercial gesture, MeDirect offers to reimburse part of these fees, subject to specific conditions:

- • Maximum reimbursement of 100 euros per transferred line.

- • Minimum transferred line value of 500 euros for eligibility (or the equivalent of 500 euros for securities that are quoted in a different currency).

- • Total reimbursement capped at 500 euros per client throughout the relationship with MeDirect. Once the 500-euro maximum has been reached, no further potential asset transfers will be eligible for reimbursement.

To process the reimbursement, an official account statement is required. The account statement must explicitly mention that it concerns an asset transfer fee and the amount charged. Once the asset transfer is completed, you can submit the proof, and we will take the necessary action to reimburse you as soon as possible on your current account.

Types of Asset Transfer

Transfer of Mutual Funds or ETFs

Transfers of Mutual Funds or ETFs necessitate proof of the initial purchase for tax purposes. We need the proof as Mutual Funds or ETFs that invest 10% or more in qualifying debt claims (such as fixed income securities) are subject to the ‘Reyndertaks’ which is a capital gains tax of 30%. To calculate the capital gain accurately at the moment of sale, we need to know the initial purchase price. If we do not receive proof of purchase, we will be required to take 01/07/2005 as the initial purchase date (and the relevant price of the fund at that date as the purchase price) or the start date of the fund for funds that were created after 01/07/2005.

Internal transfer

Transfer from Abroad

Good to know

- • Please make sure that your account at your other bank or broker has sufficient funds to cover the potential transfer fees that they might charge.

- • It always helps to inform your other bank or broker in advance that you plan to transfer (part of) your portfolio to MeDirect. This way they can inform you beforehand of any fees or other specific requirements (for example whether the account is subject to the tax on securities accounts, and a provision needs to be provided for this in the account). However, it is not mandatory to inform them proactively.

- • Rights and coupons cannot be transferred.

- • If there is a corporate action or dividend payment with an ex-date while the transfer is still being processed, the corporate action or dividend payment will be booked on the securities account where the securities are at the moment of the ex-date, even if the actual payment is after the asset transfer has been processed.

- • It is only possible to transfer available securities, meaning for example that if you have an outstanding sell order on your securities with your other bank or broker, these securities cannot be transferred. If you wish to transfer them, ensure the outstanding sell order is cancelled. Additionally, once we have started the asset transfer process with the other bank or broker, the securities that you have requested to transfer will not be available for selling.

- • When transferring bonds, please keep in mind that withholding tax will be debited from the account at the other bank or broker.

- • If you wish to transfer US securities, you must have a valid W-8-BEN form. For joint accounts, both the account holders will need to have a valid W-8BEN form. The form can be found in the Document Centre in your Profile.

- • If you wish to transfer assets from different financial institutions, we will need a separate request for each institution.

- • Please ensure that transfer form B has a wet ink signature, as most banks in Belgium do not accept asset transfer forms which are signed electronically. If it concerns an asset transfer to a joint account, both account holders will have to sign the asset transfer form.