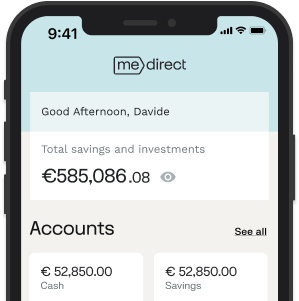

MeDirect

Dynamic Savings

A round-the-world trip, or maybe a bigger TV? Yes, you can. For here’s an account that’s just as spontaneous as your plans.

Category A – This is a ‘classic’ savings account, i.e. no conditions apply to either the basic interest rate or the loyalty bonus.

Attractive rates |

|---|

base rate: 1,10% on annual basis fidelity rate: 0,30% on annual basis |

| No capping |

|---|

Put in as much as you like |

Instant access |

|---|

Take out cash anytime. If you withdraw your money before the end of the 12-month period, you will not receive a loyalty premium on this money. |

It's free |

|---|

Talk about saving money |

Online saving for spontaneous souls

How long can you save? Forever and ever. With the open-ended Dynamic Savings account, you’re the one to decide where it ends.

Interest rates aren’t set in stone. If yours change, we’ll email you. The correct rates are always on our website, too.

Saving up for a rainy day—and then suddenly it’s pouring. No worries: you can withdraw as much as you like, whenever you like. It’s your money.

If you withdraw your money before the end of the 12 month period, you will not receive a loyalty bonus on that money. Your account exists online only. View it wherever you are and make changes anytime.

Mark January 1st in your calendar: that’s when we’ll pay your 1,10% base rate. The acquired fidelity premium will be paid into your account on the first day following the quarter during which the premium was acquired: January 1st, April 1st, July 1st and October 1st, or upon closing of the account. The fidelity premium will only be earned for amounts that remain continuously in the account for 12 consecutive months. The applied rate remains unchanged during this 12-month period and will be equal to the rate in effect at the time of the money deposit, even if it has been modified in the meantime.

Please read our Essential information for savers before opening an account.

This is a regulated savings account with an indefinite duration created by MeDirect Bank S.A. (Belgian law applies).

Bankruptcy risk: if we ever go bankrupt, your savings will be guaranteed up to € 100.000 euro. Any deposits you have over € 100.000 euro could be reduced or converted into shares (bail-in).

Inflation risk: Continuing price rises could lead to a loss in value of the saved money.

Up to € 1050 of interest per person, you don’t pay any taxes. For interests that exceed this amount, you’ll pay a withholding tax of 15%.

There’s also a double exemption up to and including € 2100 for a joint account with a cohabiting or married partner.

This tax regime applies to retail customers residing in Belgium.

Any complaints should first be directed to [email protected]

If you disagree with our proposed solution, you can contact the Consumer mediation office for financial services (Ombudsfin), Boulevard du Roi Albert II 8, box 2, B-1000 Brussels. 02/545.77.70,

ombudsman@

ombudsfin.be.

Or maybe this is more your thing

MeDirect

Essential Savings

Unexpected situations? This savings account yields right from the start and helps you deal with bad surprises!

MeDirect

Fidelity Savings

You’re the kind to keep your eyes on the ball. You’re saving up for something big. New wheels, maybe, or a little house on the prairie. Maybe even a big one.

In case you are fresh to start.

How do I open an account ?

- Click ‘Become a client’ to start the online application process. You will be asked if you wish to open up a single or a joint account. Complete your personal data as requested on screen.

- You will be guided to provide a clear copy of the front and back of a valid Belgian ID and to take a selfie.You can choose from the following 2 options:

- Use your smartphone to take a photo of your ID and a selfie.

- Upload a photo or a scan of your ID and take a selfie using the camera on your electronic device (eg webcam).

- Complete the online application process and sign it digitally. Keep your mobile close at hand.

- Make a first payment to your MeDirect Cash Account from an external account registered in your name.

- If you applied to open a joint account, you can transfer your first payment from an external joint account (registered in the name of both account holders) or from two different accounts, each registered in the name of the individual account holder.

- Once the payment has been received, a MeDirect Cash Account will be opened for you. You will then get full access to the secure website.

How can I deposit funds in my account?

You can deposit funds by instructing a bank transfer from an external bank account to your MeDirect account.

Are there any fees for opening an account?

Helpful answers

Start saving

The sooner you start managing your money your way, the sooner you’ll see results. Make your own choices and find what feels good. Sign up and open your account in a heartbeat.