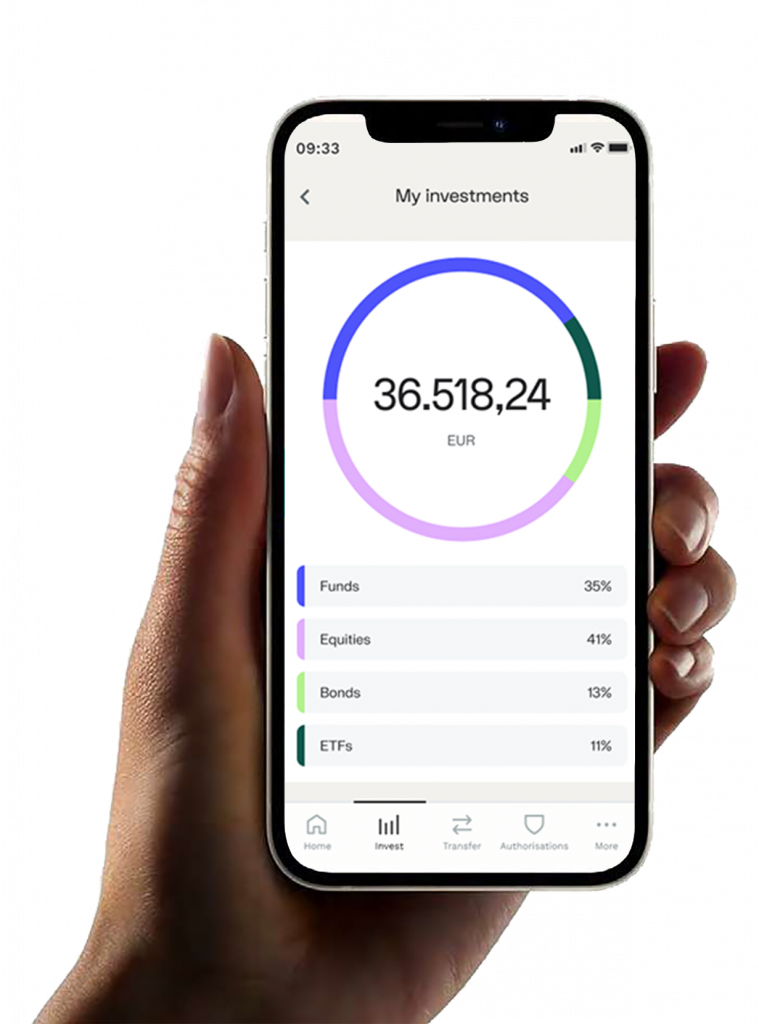

Invest on your own

A free account. No unnecessary fees. Many investment options.

You call the shots.

You call the shots.

Bonds

We have bonds from Europe, North America and beyond. Now it’s up to you to choose the ones that fit you best.

Most popular bond issuers at MeDirect

“Most popular” means the bond issuers that have attracted the most buy transactions from MeDirect customers over a 3 month period. The list is updated at the beginning of each month and covers the period of the previous 3 calendar months.