Everything about orders

Discover everything about the various order types and order duration options at MeDirect.

Order types

Limit order:

A limit order can be used when you want to control the price at which you buy or sell a security. It enables you to set a minimum sale price and/or a maximum buy price.

When you place a buy order with a limit, the order could only be executed when the security price reaches the set limit or goes below that limit. If the limit price is reached, your order might be executed, but it will never be executed above the limit you have set. In other words, you cannot buy at a higher price than the limit you have set. In exceptional circumstances at market opening, if the securities market price would suddenly drop, your buy order could even be executed below your set limit.

A sell order works in the same way but in the opposite direction. When you place a sell order with a limit, the order could only be executed if the security price reaches the set limit or if it exceeds that limit. If the limit price is reached, your order could be executed, but never under the limit you have set. In other words, you cannot sell at a price lower than the limit you have set. In exceptional circumstances at market opening, if the securities market price would suddenly increase, your sell order could even be executed above your set limit.

Example 1:

You want to buy shares of company XYZ at a maximum price of 160 EUR. You set a buy order with a limit of 160 EUR. During the trading day, if the market price reaches 160 EUR, then your order could be executed at that price. If the market opens at 140 EUR, your buy order could be executed at 140 EUR, thus even below your set limit of 160 EUR. Your securities account will be credited, and your current account will be debited.

Example 2:

You place a sell order on your shares of company XYZ, with a sell limit of 170 EUR. During the trading day, if the market price reaches 170 EUR, then your order could be executed. If the market opens at 190 EUR, your sell order could be executed at 190 EUR, thus even above your set limit of 170 EUR. Your securities account will be debited, and your current account will be credited.

Please note that there is never a guarantee that any buy or sell order will be executed, as it depends on various factors such as market liquidity.

Please note that a limit order might only get partially executed. This means that if you want to buy or sell 50 shares at a price of 160 EUR, but the minimum price reached on that day is 160 EUR for a volume of only 25 shares, then only 25 shares will be bought or sold. A partial execution is considered as the execution of an order, which means that fees and commissions will be levied.

Market order:

A market order can be used when your priority is not the price at which an order is executed, but mainly the chance of execution. By placing a market order, your order will be executed at the current market price (ask price if buying and bid price if selling). In most instances, your order could be executed immediately, under the condition that the market is open, and that the available volume is sufficient to fill your order.

Please note that in some cases, the current market price may significantly deviate from the last known price (for example, if trading volumes are low or if bid/ask spread is important). Consequently, the price at which your order will be executed may also deviate significantly from the last known price.

Execution of a market order is never guaranteed.

Order expiration options

Day order:

A day order is a limitation in time of a given order. It will only remain active during the trading day on which it was placed. If the order is not executed, it will be cancelled automatically after the market closes. In the event of a partial execution, the remainder of the pending order will be cancelled automatically after the market closes.

Market orders can only be set as day orders.

When it comes to limit orders, you can choose between a day order, a ‘Good until Cancelled’ (GTC) order and a ‘Good until Date’ order (GTD).

Good ‘till cancelled (GTC) order:

A ‘Good until Cancelled’ order will remain active until it is either executed or manually cancelled, whichever happens first. In theory, this is an order type with no expiration date. In reality, however:

- Limit orders with GTC validity will automatically be cancelled after six months to protect the investors from long-forgotten orders being executed.

Please note that there are different possible scenarios in which your order might be cancelled. These may include corporate actions that take place, ex-dividend date of a coupon, a specific request from the stock exchange to cancel, and so on. This list is not exhaustive.

Good ‘till date (GTD) order:

A ‘Good until Date’ order will remain active until a specified, preset date, for example the end of the week or the end of the month. It is possible to select a date up to six months in the future. Once the specified date has passed, the order will be cancelled automatically if it has not been executed. If the order has been partially executed, the remainder of the pending order will be cancelled automatically once the specified date has passed.

Please note that there are different possible scenarios in which your order might be cancelled. These may include corporate actions that take place, ex-dividend date of a coupon, a specific request from the stock exchange to cancel, and so on. This list is not exhaustive.

This is not investment advice, but merely aims at describing the different options clients can choose from when investing in securities.

Stop loss – Take profit order:

What is a Stop Loss – Take Profit order?

Stop Loss (SL) and Take Profit (TP) orders are used by investors to either reduce their potential loss on a position or to safeguard a profit by setting specific price limits. If either of the set limits are hit, the position could automatically be sold in the market.

The order generated by using the Stop Loss – Take Profit type will by default always be a Good until Cancelled (GTC) order. However, in this specific case there will be no expiration date and the order will not be automatically cancelled (after 6 months).

The Stop Loss – Take Profit order will therefore remain outstanding until it is manually cancelled by the investor, or for a specific reason such as a corporate action, an ex-dividend date of a coupon, a specific request from the stock exchange to cancel, etc. This list is not exhaustive.

Stop Loss and Take Profit orders can be placed on most equities and ETFs.

Please note that if there is a sudden price drop in the security, your sell order might be executed at a price significantly lower than your pre-set Stop Loss limit.

How to set a Stop Loss – Take Profit order:

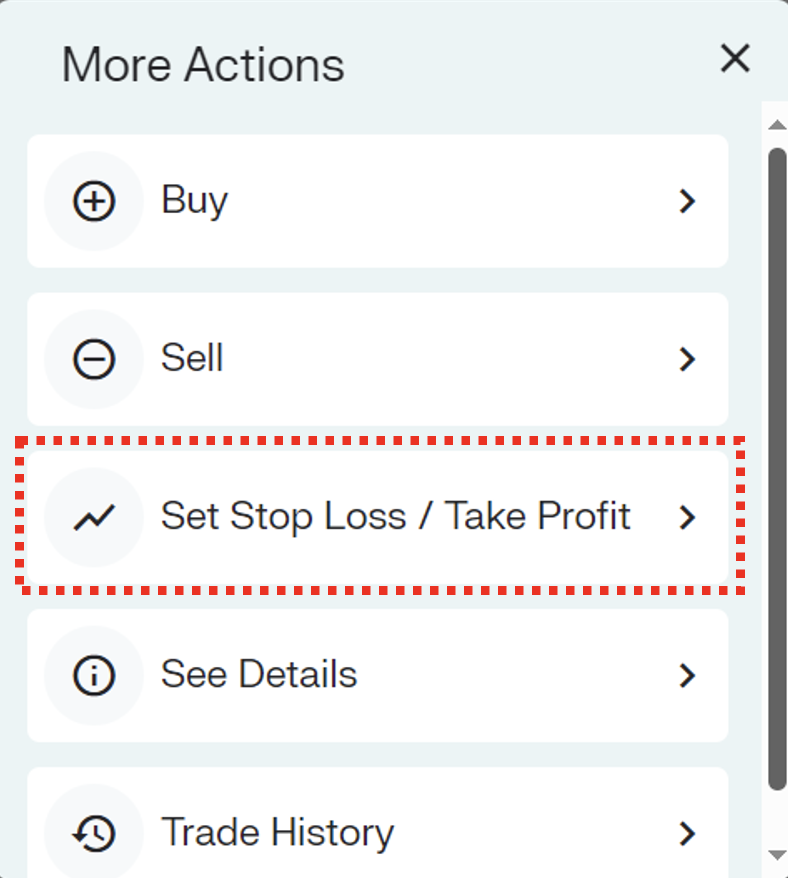

It is possible to add a Stop Loss – Take Profit order to an existing position. Simply go to the position where you want to add Stop Loss – Take Profit limits and go to ‘More Actions’, there you will find the option ‘Set Stop Loss / Take Profit’:

You fill in the Stop Loss limit, Take Profit limit, or both and you can review and enter your order:

From an existing position it is also possible to enter Stop Loss – Take Profit limits on part of your position.

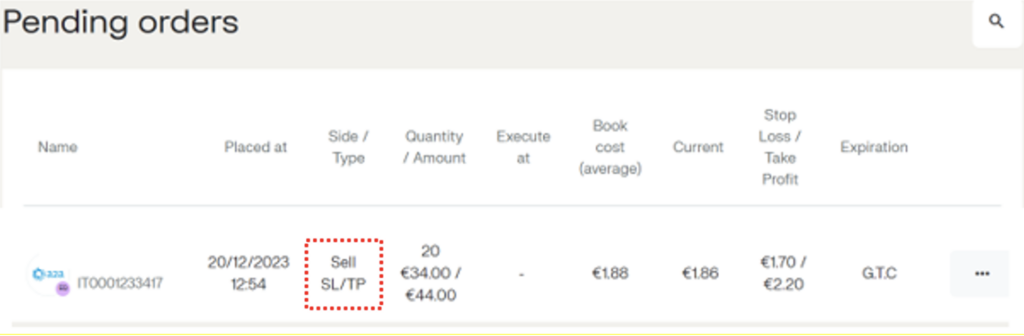

The Stop Loss – Take Profit limits can still be edited or deleted from the pending orders.

What happens when there is a partial execution on my buy order?

When there is a partial execution on the initial buy order, a Stop Loss – Take Profit order will be visible in the pending orders menu for the amount of shares that have been executed.

Please note, if the Take Profit limit is hit on the amount of shares in portfolio, that amount will be sold, and the remainder of the pending buy order and linked Stop Loss order will automatically be cancelled.