Straight to the point

Can’t tell a fund from another, let alone find your fit?

Agreed, investing is not simple. That’s why we’ve developed two investment packages that combine different solutions. Take your pick and get started today.

READY MADE

Sustainable MeGreen

- Put your money where your heart is, and take a stake in 5 funds that are kind to both people and planet

- Selected with NN Investment Partners

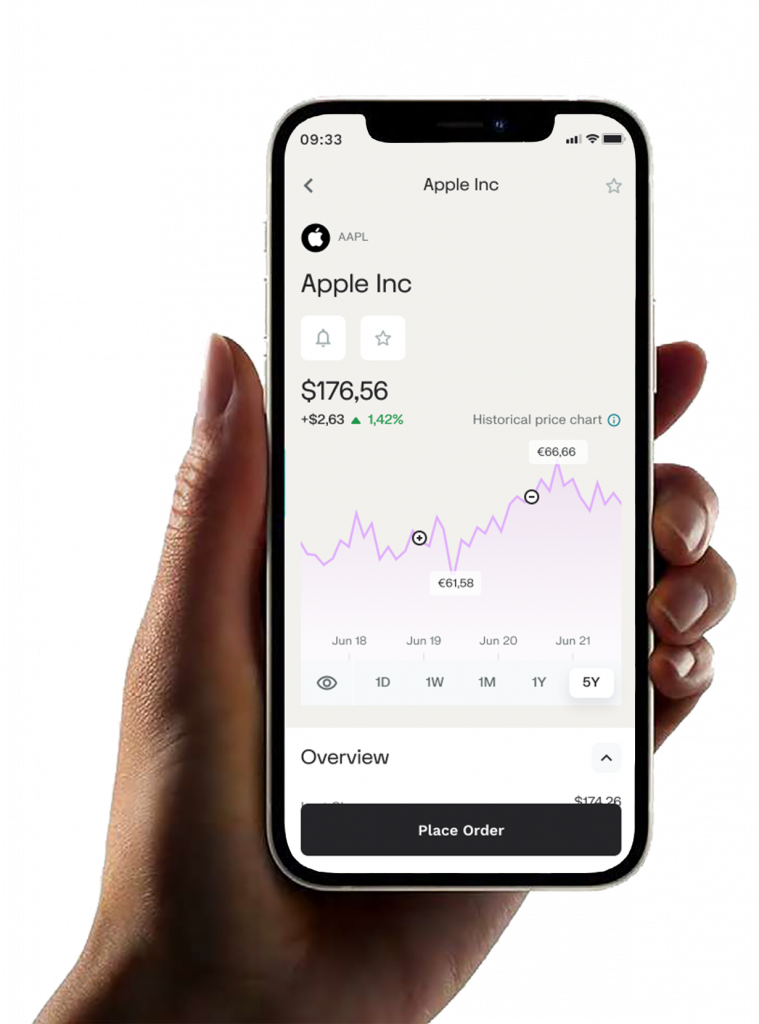

Start seeing results

The sooner you start managing your money your way, the sooner you’ll see results. Make your own choices and find what feels good. Sign up and open your account in a heartbeat.